How do we perform investment management?

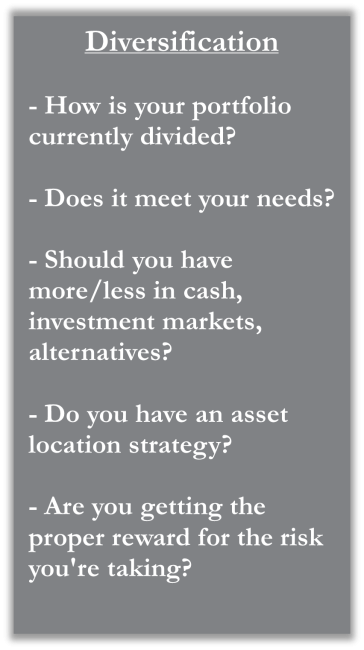

Our investment management philosophy is centered around these guiding principles:

- Protect and preserve the wealth you've attained.

- Take justified risks.

- Asset allocation and rebalancing help reduce risk.

- Portfolio performance should be measured against your goals, not a benchmark.

- Cash flow strategies should be personalized and designed to avoid accumulating too much or having too little.

- Tax reduction strategies can have a large impact on your overall wealth.

Investment management is complex. There are many moving parts. The investment landscape is ever-changing, and when changes occur, the media loves to create headlines. Having principles to fall back when life gets chaotic on can help keep you grounded and stay on course.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. No strategy or asset allocation assures success or protects against loss.